Relevant Life for Directors: The Complete UK Guide

Published

5 August 2025 | 9 min read

Article Summary

What is a Relevant Life Policy?

Relevant Life insurance for directors is employer-funded life cover that provides a death in service style benefit to an employee of a limited company. The company pays the premiums, which are usually deductible if incurred wholly and exclusively for the business, with no benefit in kind for the employee. Policies are typically written in trust so the lump sum is paid to family or other individual beneficiaries, which makes this approach ideal for SMEs that do not run a group life scheme.

What does it offer?

A Relevant Life Insurance Policy is a company-paid life insurance arrangement that gives an employee or director personal life cover, while using the employer as policyholder. HMRC treats these as relevant life policies when they meet conditions similar to an excepted group life policy, including limits on beneficiaries, permitted benefits and age. HMRC’s guidance confirms how a qualifying relevant life policy is treated for employment income purposes.

In practice, the policy pays a lump sum if the life assured dies during the term. Premiums are paid by the company. When structured correctly, the expense is normally allowable if it meets the wholly and exclusively test for business purposes, and the benefit for the employee is typically exempt from a benefits‑in‑kind charge under section 307 ITEPA.

Most policies are set up under a discretionary trust so that proceeds pass rapidly to chosen beneficiaries and remain outside the estate. HMRC’s beneficiary conditions require that benefits are payable to individuals or charities, rather than the employer. This approach supports prompt distribution and connects with general trust and inheritance tax principles.

What a Relevant Life Policy can and cannot cover

To qualify, the policy must only provide permitted benefits. HMRC sets the guardrails: no surrender value, benefits limited to death with terminal illness typically acceptable, an upper age limit that does not exceed 75, and beneficiaries restricted to individuals or charities. See HMRC on permitted benefits and no surrender value, the age 75 condition, and who may benefit.

If you are weighing up business cover that pays the company rather than your family, read our guide to Key Person (Key Man) Insurance.

At‑a‑glance comparison

| Topic | Relevant Life (company funds) | Personal life insurance |

|---|---|---|

| Who pays | Employer pays the premium | Individual pays from post‑tax income |

| Tax on premium | Usually deductible if wholly and exclusively; typically no benefit in kind | No corporation tax relief; individual has already paid income or dividend tax |

| Beneficiary | Individuals or charities via trust | Estate or nominated beneficiary |

| Critical illness add‑on | Not permitted under excepted policy rules | Available on many personal policies |

| Pension interaction | Outside registered schemes. See new lump‑sum allowances | N/A |

Key benefits for directors and small employers

Tax‑efficient funding through the company. When a policy is part of a genuine remuneration package, premiums are usually deductible if incurred wholly and exclusively. On the employee side, the cover is commonly exempt from a P11D charge under section 307 ITEPA.

No impact on the employee’s pension allowances. Relevant Life sits outside registered pension scheme benefits. HMRC’s EIM guidance and the Insurance Policyholder Taxation Manual set the conditions for excepted life arrangements. For context, the Lifetime Allowance was abolished on 6 April 2024 and replaced by new allowances for lump sums and death benefits.

Personal protection delivered tax‑efficiently. Instead of drawing post‑tax money to pay a personal policy, the company funds the premium. If your company is taxed at current Corporation Tax rates and you are a higher‑rate taxpayer per income tax bands, using the business to fund a Relevant Life premium can reduce the overall cost for equivalent cover. The saving depends on profit levels, marginal tax rate and how you normally extract income.

A trust framework for quick payment to your family. A discretionary trust aligns with HMRC’s beneficiary restrictions and helps keep proceeds outside the estate under general trust and IHT rules. MoneyHelper also provides accessible guidance on using trusts to reduce inheritance tax exposure.

Who qualifies, and when it makes sense

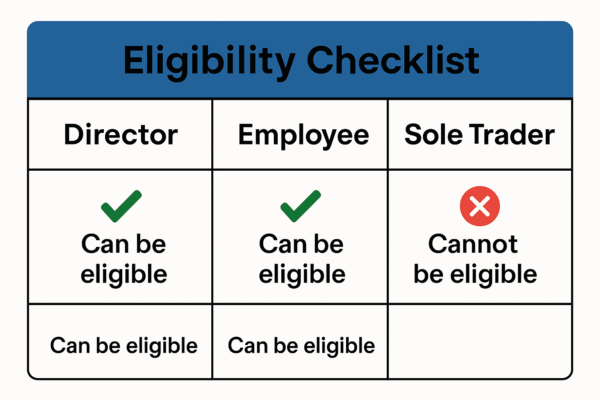

You need an employer–employee relationship. Relevant Life is an employer benefit for an employee or office holder. Directors are classed as employees for National Insurance purposes, which is why a limited company can provide this type of cover for a director on payroll.

Sole traders cannot use Relevant Life for themselves. A sole trader is not an employee of a separate legal entity, so the structure does not fit the employer‑funded model set out by HMRC. If you operate as a sole trader or a non‑salaried partner, consider a personal policy. For a primer on life insurance, see MoneyHelper’s guide to what life insurance is.

Cover must follow excepted‑policy conditions. Broadly, that means benefits are limited to death, there is no surrender value, beneficiaries are individuals or charities, and cover does not run beyond age 75.

No critical illness or disability riders. Excepted policy rules allow only death benefits. Ill‑health or disablement benefits are excluded in IPTM7030 and the EIM guidance. If you need illness cover, consider a separate personal policy or business cover designed for that purpose.

Step‑by‑step setup

- Decide the lump sum and the term. Think about what your family would need and align the term with your working horizon. Keep insurer limits and HMRC conditions in mind, such as the no‑surrender‑value requirement and age limit.

- Choose an insurer and complete underwriting. The process mirrors standard life insurance: health questions, possibly a medical if the sum assured is high.

- Put the policy under a discretionary trust from day one. This helps keep benefits outside your estate and directs funds to the people you choose. HMRC sets out who can benefit under an excepted policy in IPTM7035.

- Pay premiums from the company and keep clean records. Your accountant will want to see that premiums form part of a normal benefits package and meet the wholly and exclusively test for corporation tax. On the employee side, the exemption from a P11D charge comes from ITEPA s307.

Want a hand with the trust deed, sums assured and documentation? Start with our Guide to Relevant Life Cover or speak with us for tailored help.

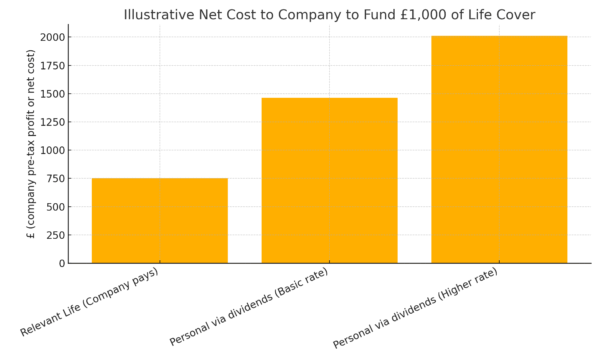

Illustrative cost comparison

The chart below shows an illustrative net cost to the company to fund £1,000 of life cover in different scenarios. It assumes a 25% corporation tax rate and dividend tax at basic and higher rates. Figures are for education only and are not advice.

If you would like the underlying figures for your records, ask us for a tailored calculation based on your profit level, extraction method and personal tax band.

Eligibility checklist

| Status | Eligible for Relevant Life? | Notes |

|---|---|---|

| Company director on payroll | Yes | Director counts as an employee for NI purposes. See directors’ NI rules. |

| Employee | Yes | Employer can provide the benefit. |

| Sole trader for own cover | No | No employer‑employee relationship. Consider a personal policy instead. |

| Non‑salaried partner | Usually no | Depends on structure. Seek advice. |

| Age at end of term over 75 | No | Breaches age 75 condition. |

| Wants critical illness rider | No | Not permitted under IPTM7030. |

Relevant Life vs other options

Relevant Life vs personal life insurance. Personal policies are paid from post‑tax income. A Relevant Life policy is paid by the employer, with potential corporation‑tax relief if costs are wholly and exclusively, and typically no benefit in kind for the employee.

Relevant Life vs Key Person Insurance. Relevant Life benefits your family. Key Person benefits your company. HMRC’s beneficiary rules for excepted policies make it clear that policies paying the employer or co‑owners do not qualify as excepted life policies.

Relevant Life vs Shareholder Protection. Shareholder Protection is designed to fund a buy‑out of shares, usually with policies written under cross‑option agreements. That is different from a family benefit.

Relevant Life vs group life schemes. Larger employers often use registered group life policies within a pension wrapper. SMEs may not have the headcount for that. The ABI explains how group life pays a lump sum to families. Relevant Life provides a similar outcome for individuals but sits outside the registered‑scheme framework and follows HMRC’s excepted policy conditions. For context on the pension side, note the abolition of the Lifetime Allowance and replacement with new lump‑sum allowances.

A quick worked example

This is an illustration only. Suppose a company pays £1,000 a year for a director’s Relevant Life premium. If the company pays Corporation Tax at the main rate, the effective cost after tax relief could be lower than £1,000. If the director instead paid £1,000 personally, they would first need to extract that £1,000 as salary or dividends, which brings in income tax bands and potentially National Insurance. The difference in funding route is where much of the saving arises. Your figures depend on profit levels, remuneration mix and tax bands. Please speak with your accountant for a personalised calculation.

FAQs

Is Relevant Life a benefit in kind for the employee?

Not usually. Where conditions are met, employer spending on a lump‑sum death benefit is generally exempt under ITEPA s307. Your accountant should still ensure the company claims the expense on a wholly and exclusively basis.

Can a sole trader take Relevant Life cover on themselves?

No. The structure requires an employer–employee relationship. Directors on payroll are treated as employees for NI purposes. Sole traders are not employees of a separate entity.

Can I include critical illness?

No. Excepted policy conditions permit death benefits only and forbid other benefits like ill‑health or disability cover. See IPTM7030 and HMRC’s relevant life policy guidance.

Does the payout form part of my estate for IHT?

When the policy is under a discretionary trust and benefits are paid to individual beneficiaries, proceeds are generally outside the estate. See HMRC on beneficiaries for excepted policies and trusts and inheritance tax.

What about lifetime allowance limits?

Relevant Life sits outside registered pension benefits. For registered schemes, the Lifetime Allowance was abolished on 6 April 2024 and replaced by the lump sum allowance and the lump sum and death benefit allowance.

The bottom line

For many UK directors, a Relevant Life Policy is a precise way to protect family finances while using company funds efficiently. It aligns with HMRC’s framework for death‑benefit provision, it can sit neatly in a benefits package, and it avoids common pitfalls like benefits‑in‑kind charges when structured properly. If you want help selecting a sum assured, setting up the trust and coordinating with your accountant, start with our Guide to Relevant Life Cover or talk to us about a tailored plan. If you also want to protect the business itself, pair this with Key Person cover and, where needed, Shareholder Protection.